The Greatest Guide To Stonewell Bookkeeping

The Best Strategy To Use For Stonewell Bookkeeping

Table of ContentsNot known Factual Statements About Stonewell Bookkeeping Excitement About Stonewell BookkeepingStonewell Bookkeeping - QuestionsStonewell Bookkeeping Things To Know Before You BuyOur Stonewell Bookkeeping Statements

Instead of going with a declaring cupboard of various documents, invoices, and receipts, you can present detailed records to your accounting professional. Subsequently, you and your accountant can save time. As an added benefit, you might also have the ability to identify possible tax write-offs. After utilizing your accounting to file your taxes, the internal revenue service might choose to execute an audit.

That funding can come in the form of proprietor's equity, gives, service loans, and financiers. Investors require to have an excellent idea of your business prior to investing.

Not known Facts About Stonewell Bookkeeping

This is not intended as lawful advice; for more details, please click here..

We addressed, "well, in order to know how much you need to be paying, we need to know just how much you're making. What is your web earnings? "Well, I have $179,000 in my account, so I presume my net earnings (profits much less expenditures) is $18K".

Stonewell Bookkeeping for Beginners

While maybe that they have $18K in the account (and even that might not hold true), your balance in the bank does not always determine your revenue. If somebody received a grant or a loan, those funds are ruled out income. And they would not infiltrate your earnings declaration in establishing your earnings.

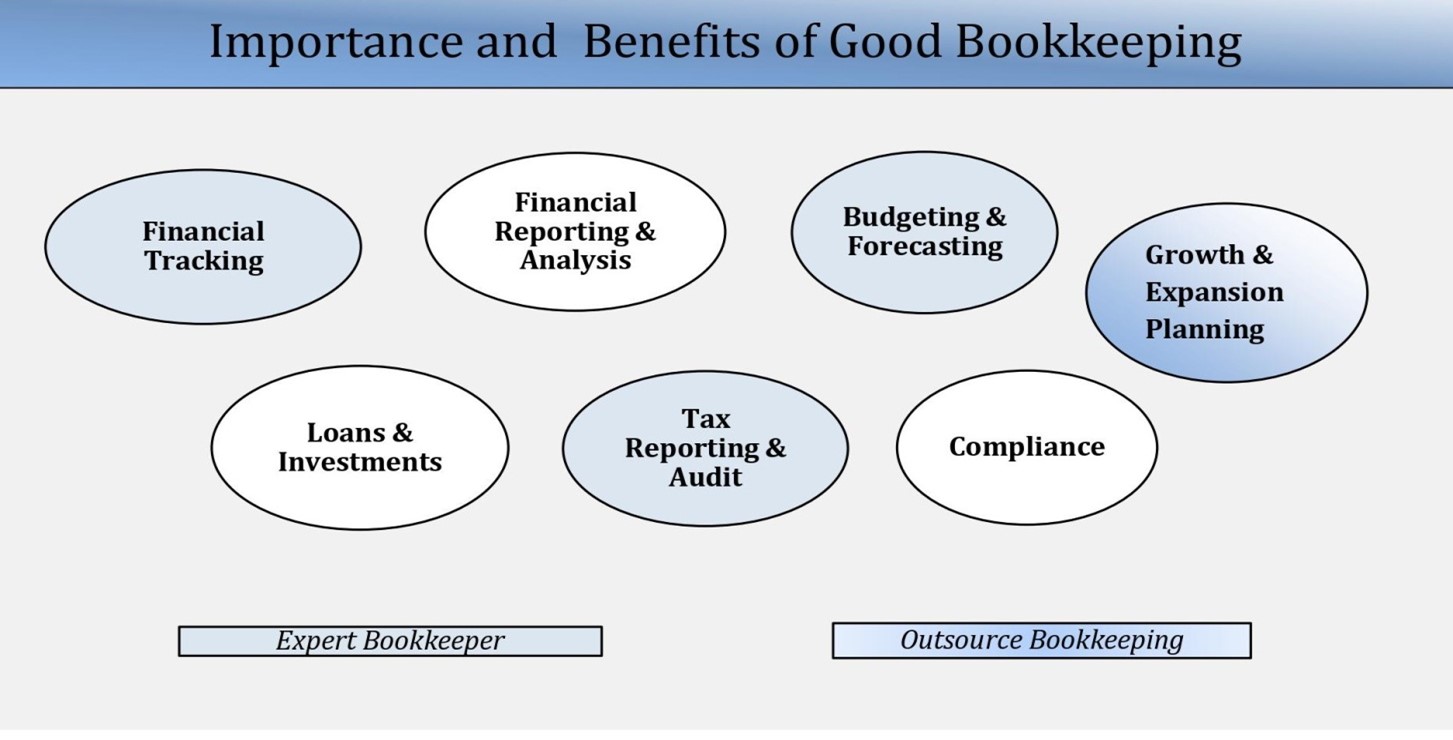

Many points that you think are expenses and reductions are in truth neither. A correct collection of publications, and an outsourced accountant that can effectively identify those transactions, will certainly assist you determine what your business is truly making. Accounting is the procedure of recording, classifying, and organizing a company's monetary transactions and tax obligation filings.

A successful company requires assistance from experts. With practical goals and a skilled bookkeeper, you can quickly resolve obstacles and keep those fears at bay. We're here to help. Leichter Bookkeeping Solutions is a knowledgeable CPA firm with a passion for audit and devotion to our customers - franchise opportunities (https://hirestonewell.wordpress.com/2025/12/16/why-bookkeeping-is-the-backbone-of-every-successful-business/). We commit our power to guaranteeing you have a strong financial structure for development.

The Greatest Guide To Stonewell Bookkeeping

Precise accounting is the foundation of excellent financial administration in any kind of company. With great accounting, businesses can make better decisions due to the fact that clear monetary records supply useful data that can lead approach and improve profits.

On the other hand, solid bookkeeping makes it less complicated to protect funding. Precise financial declarations build count on with loan providers and financiers, enhancing your chances of getting the capital you require to expand. To keep solid financial health, businesses should frequently integrate their accounts. This indicates coordinating purchases with financial institution declarations to catch errors and stay clear of economic discrepancies.

An accountant will certainly cross financial institution statements with internal records at least once a month to locate mistakes or incongruities. Called bank settlement, this process ensures that the financial documents of the firm match those of the financial institution.

They keep track of existing pay-roll data, subtract tax obligations, and figure pay scales. Accountants generate fundamental economic reports, consisting of: Earnings and Loss Statements Shows earnings, expenses, and web revenue. Annual report Details properties, obligations, and equity. Capital Declarations Tracks cash money activity in and out of business (https://slides.com/hirestonewell). These records aid local business owner understand their monetary placement and make educated choices.

The Main Principles Of Stonewell Bookkeeping

The most effective selection depends upon your spending plan and business needs. Some small company proprietors prefer to take care of bookkeeping themselves utilizing software program. While this is cost-effective, it can be time-consuming and prone to errors. Tools like copyright, Xero, and FreshBooks permit local business owner to automate bookkeeping jobs. These programs help with invoicing, bank reconciliation, and monetary coverage.